Today’s trading brings renewed concerns for the stock market — is the downtrend resuming?

The S&P 500 closed 0.17% lower on Tuesday, fluctuating within Monday’s trading range. The market is much less volatile following last week’s wild swings, but this morning futures indicate it will open 0.7% lower due to news from the Trump administration about a ban on selling some types of chips from Nvidia to China.

Investor sentiment remained bearish, as shown in the last Wednesday’s AAII Investor Sentiment Survey, which reported that 28.5% of individual investors are bullish, while 58.9% of them are bearish.

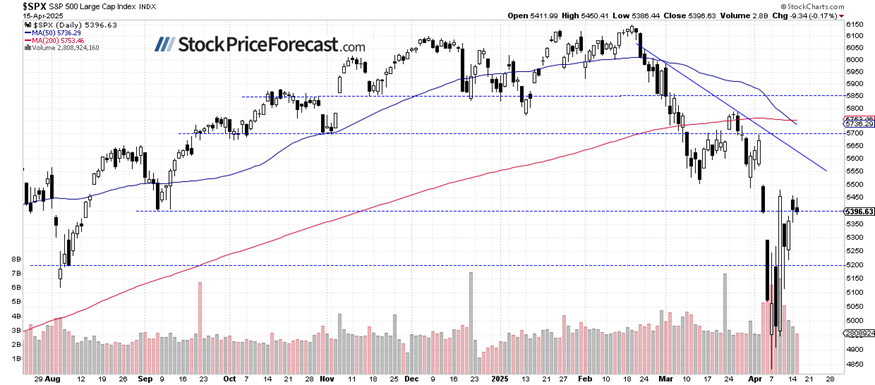

The S&P 500 continues to trade below key 5,500 resistance, as we can see on the daily chart.

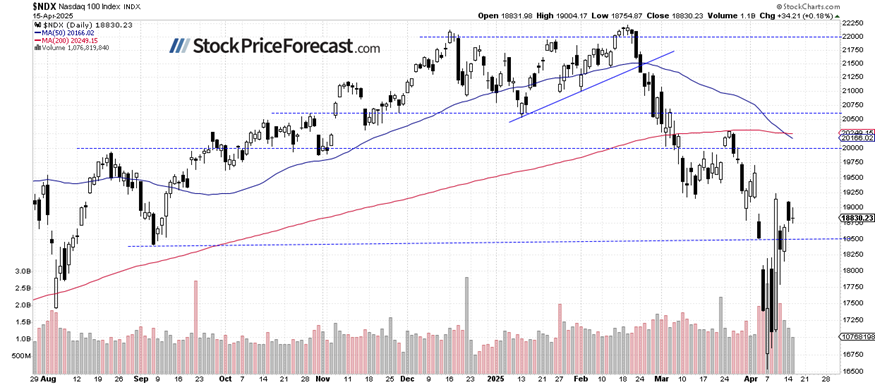

Nasdaq 100 – Tech under pressure

The Nasdaq 100 is facing pressure this morning due to chip restrictions. Futures suggest a 1.4% lower open, with semiconductor stocks like Nvidia seeing the most significant impact. The decision to limit exports of Nvidia’s crucial H20 AI chip to China is weighing on the tech sector.

Resistance remains around 19,000-19,200, while support is around 18,200-18.500.

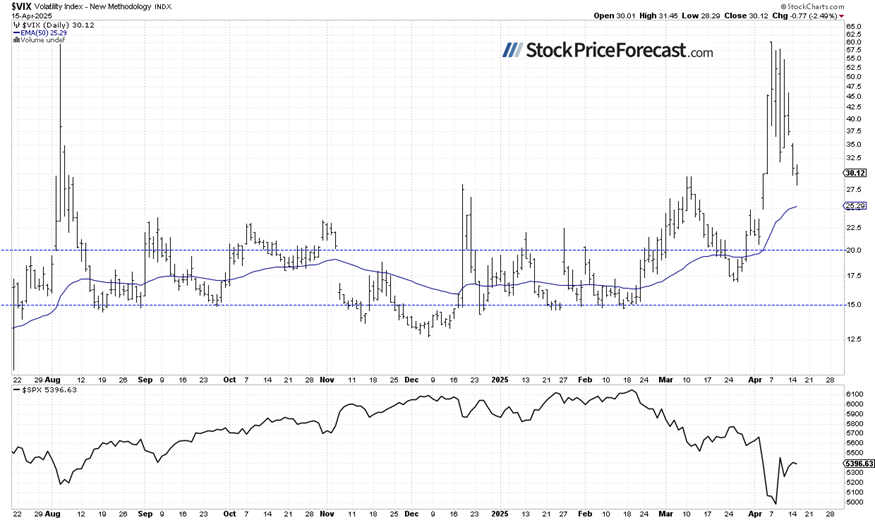

VIX pulling back

The VIX retreated to a local low of 28.29 yesterday while remaining elevated. It may see an uptick today as investors react to the new export limitations on the tech sector.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

S&P 500 futures contract: Moving sideways

This morning, the S&P 500 futures contract is trading lower, pressured by the chip export restrictions news. The market appears to be losing the stability it showed earlier this week, but a large move lower seems less likely from here.

Key support remains around 5,300-5,350, marked by the recent fluctuations. Resistance remains around 5,500.

Last Wednesday, I noted that “The contract may be forming a double-bottom pattern, though it’s too early to confirm.” This proved correct.

Conclusion

The stock market is facing renewed pressure this morning, primarily due to the Trump administration’s decision to restrict chip exports to China. This development particularly impacts Nvidia and other semiconductor companies. The S&P 500 is set to open 0.7% lower, adding to its short-term uncertainty.

Earnings season kicked into high gear this week, with ASML reporting earlier today, Alcoa reporting after today’s session closes, and TSMC and Netflix reporting tomorrow.

The market continues to be highly sensitive to trade policy developments, and volatility is likely to persist.

Here’s the breakdown:

-

S&P 500 futures point to a lower open, pulling back from their Monday-Tuesday stability.

-

Semiconductor stocks, particularly Nvidia, are facing downward pressure due to export restrictions.

-

Fed Chair Powell’s speech later today could introduce additional volatility.

-

It is still a news-driven market, with tariff developments in focus.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.